The Greatest Guide To Surety and Fidelity Bonds - CNA

The Greatest Guide To Surety Bonds: What Owners Should Know - AIA Contract

Common such bonds are executor and administrator bonds, trustee bonds, guardian bonds, and conservator bonds. PBIB ins by statute for certain holders of public office, to secure the general public from malfeasance by an authorities or from an authorities's failure to faithfully perform duties. Public main bonds included county clerk bonds, tax collector bonds, notary bonds, and treasurer bonds.

Consisted of are a variety of bonds, such as storage facility bonds, title bonds, energy bonds, and fuel tax bonds.

Facts About Surety Bond Requirements - Louisiana Department of Insurance Uncovered

Find out the surety bond essentials with an easy-to-read overview of surety. You'll be an expert in no time! What Does a Surety Bond Mean? A surety bond (noticable "- ih-tee bond") can be defined in its easiest type as a written agreement to ensure compliance, payment, or performance of an act.

What are Surety Bonds and How Do They Work? – Diamond Valley Insurance Services

Understanding the Role of Surety Bond Companies

The three parties in a surety arrangement are: the party that acquires the bond and carries out an obligation to carry out a function as guaranteed. the insurance business or surety business that ensures the obligation will be carried out. If the primary stops working to carry out the function as promised, the surety is contractually liable for losses sustained.

Surety bonds

Some Known Incorrect Statements About Surety Bonds - Bureau of the Fiscal Service

For the majority of surety bonds, the obligee is a regional, state or federal government organization. Surety Bond Required to Know In practice, surety bonds can have several variations to their meaning, meaning, and purpose depending on the particular bond requirement. There are countless various kinds of surety bonds throughout the country.

Other surety bonds guarantee payment of tax or other monetary commitments. These bonds are described as "rigorous financial guarantee" bonds and oftentimes are more costly due to inherent threat of ensuring a payment rather than a compliance requirement. Another typical kind of surety bond called is described as a contract bond.

The Definitive Guide for 47 CFR 25.165 -- Surety bonds- eCFR

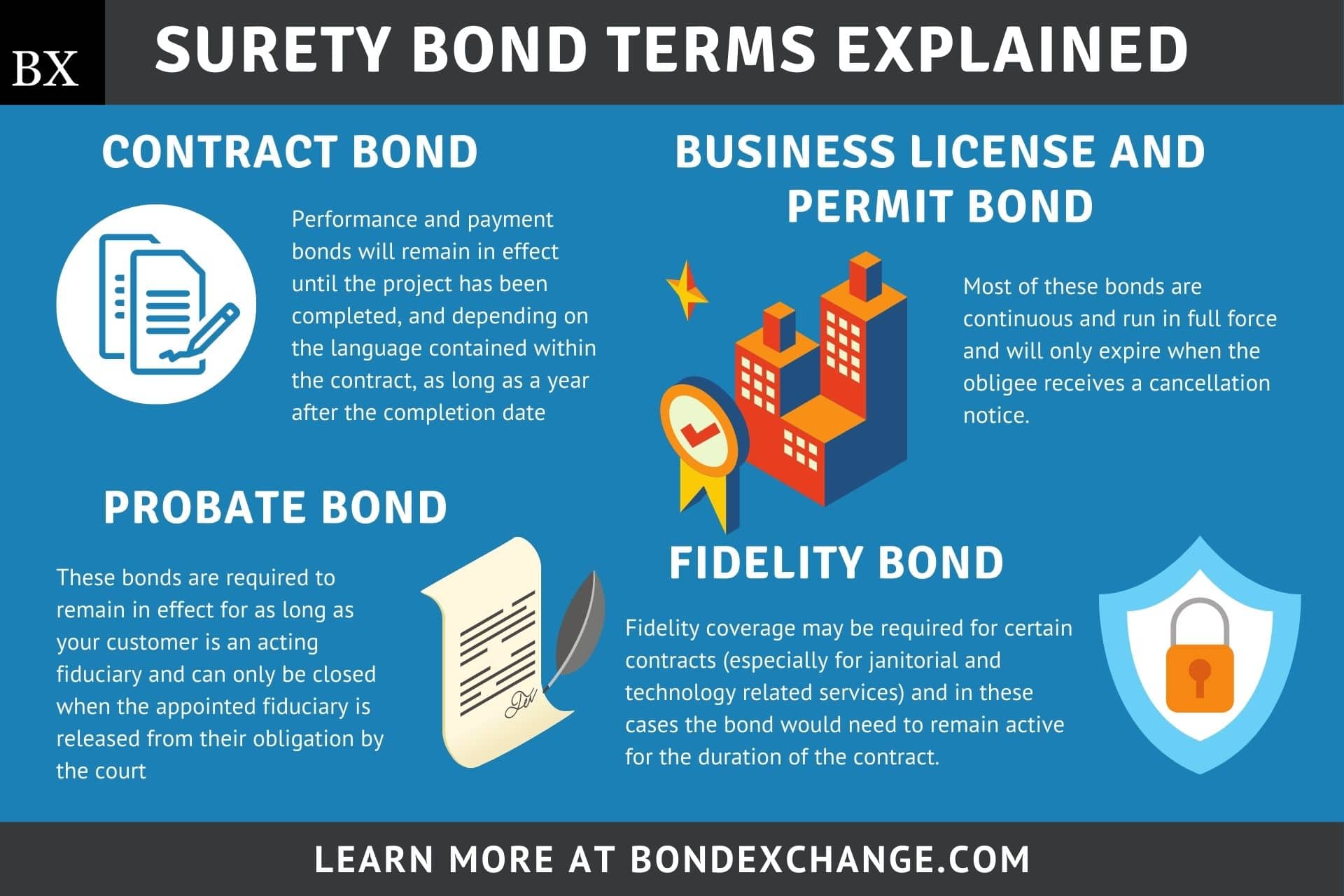

Contractors took part in a variety of both federal government agreements and economic sector work need to secure contract bonds as needed by job owners. Most surety bonds are issued for a set term (usually 1, 2, or 3 years) or they are issued as "constant" bonds. A constant bond merely implies that the bond kind is written so the bond is in force until cancelled by the surety company.